A residential property was a reliable financing choice, confirmed by large number of millionaires (90%) with services within their funding profiles. not, the newest entry barrier was large, rather than all of us have the main city to purchase a house downright. Luckily for us, you can find different kinds of mortgage loans during the Maryland; loans and you can mortgage brokers are around for people that are interested a property however, do not have the fund.

Two of the hottest mortgages are investment property mortgage loans and you can traditional mortgage loans. This short article discuss its variations to greatly help assets consumers influence the best option mortgage because of their requirements and you will finances.

What are Antique Mortgages?

Traditional mortgages was money options for anyone or family members to get a beneficial primary home. These money are generally paid down more than 15 to 3 decades with fixed rates of interest. Traditional mortgage loans was backed by the home are bought. If the borrower defaults, the lending company is grab the house or property due to foreclosure.

Preciselywhat are Money Mortgages?

Investment mortgages are money for buying attributes entirely to possess resource aim. This might be to own money age bracket, instance rental attributes and you will travel residential property, or money really love, like improve-and-flip tactics. These mortgage terms can differ. In some cases, a predetermined rates loan up to 30 years continues to be available.

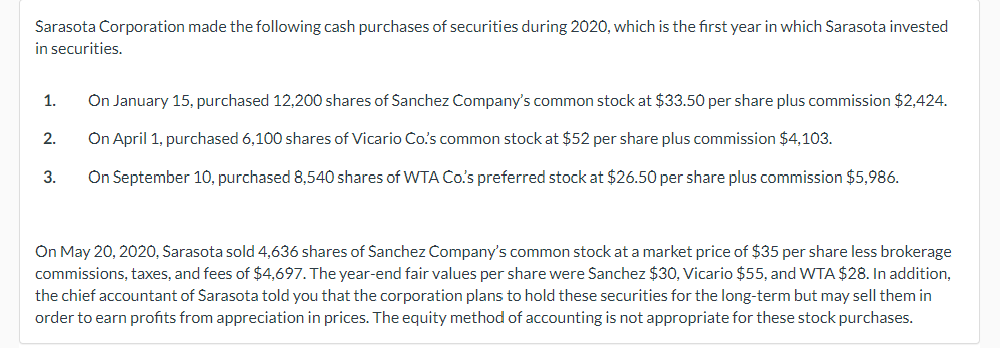

Deposit

Advance payment criteria to own old-fashioned mortgage loans are often a whole lot more easy than just investment mortgage loans. It is because loan providers check money qualities just like the riskier assets, because of field volatility, but first homes are not notably influenced by field motion.

The specific down payment number may differ considering issues such as for example credit score. Generally speaking, antique mortgages need off payments anywhere between step 3% to help you 20%, whenever you are investment mortgage loans get include 15% so you’re able to twenty-five%.

Interest levels

Rates within the mortgage loans is actually partly premised towards exposure. So that as already founded, financial support mortgage loans are considered riskier than simply conventional mortgage loans. This is why, rates of interest during these fund are into the high end. The investor’s credit score and financial status also can influence new price recharged having possibly financial.

Eligibility Standards

Brand new qualification requirements to have resource mortgages is actually strict versus traditional mortgage loans. Getting traditional mortgage loans, loan providers typically explore credit rating, debt-to-income ratio, and you will a position record to choose a beneficial borrower’s creditworthiness. Consumers taking right out a good investment mortgage must establish their ability to cover mortgage payments as a consequence of leasing money and their expertise in a residential property investing, as well as the criteria listed above.

Risk Facts Of Every type out-of Financial

Old-fashioned mortgage loans hold a serious chance when applied for to invest in a buy inside an extremely erratic sector. The brand new borrower might end with bad security, in which they are obligated to pay more the value of their property. This should succeed hard to promote the home and obvious the borrowed funds debt into the continues or even to refinance, if the you need occur.

Financing mortgage loans are also higher-risk as his or her returns, otherwise lack thereof, is tied to the fresh performance of one’s housing market. A good downturn in the market perform slow down income age group, which would apply at cost. Very long openings may also reduce the investor’s capacity to repay the brand new loan.

You should make sure When choosing Anywhere between Capital Mortgages and Traditional Mortgage loans

Choosing between the two home loan types relates to the newest designed use. A traditional home loan may have best financing terms and lower attention prices but can only be useful manager-occupied properties. Investor mortgage loans was geared to money-creating qualities.

However, you’ll find instances when each other alternatives is feasible, like home hacking, the acquisition out of vacation residential property, and you will blended-play with real estate properties. In such issues, the brand new debtor would be to assess the monetary status. A timeless financial is the most suitable in the paydayloanalabama.com/dora/ event your borrower’s credit score, a job record, and debt-to-earnings ratio try strong.

Remember that for the majority of explore cases, the fresh new borrower takes away a trader home loan and later convert it to a traditional financial. They’re:

Home flipping: An investor is also very first obtain an investment financial to order an effective property so you’re able to renovate and quickly sell they to possess money but later propose to keep it. One property perform be eligible for a traditional home loan.

Trips local rental possessions: Furthermore, a trader could possibly get acquire an enthusiastic investor’s financing to acquire a property with accommodations at heart. When they intend to follow the house or property for personal play with after, capable transfer the borrowed funds so you can a timeless financial.

Owner-filled duplex or multiple-household members assets: A person can buy a multi-unit possessions given that a good investment but later plan to invade that of products. In this case, the current individual home loan will be converted into a timeless financial.

Mention Maryland Mortgage Alternatives Which have Woodsboro Financial

Woodsboro Lender even offers certain mortgage alternatives for homebuyers and you will buyers for the Frederick Condition, Maryland, and you may encompassing components. These mortgage loans was having first-day home buyers otherwise educated a property investors trying construct, purchase, or refinance a property. Woodsboro Financial also offers HELOC, FHA, and you will adjustable-speed mortgages. Contact Woodsboro Financial right now to discuss Maryland home loan selection.