For almost all Non-Citizen Indians (NRIs), running an article of its homeland was an aspiration. Having India’s market strong, the prospect of getting property here has-been even more attractive. But how really does you to navigate it road out-of thousands of miles aside? This blog simplifies the entire process of acquiring NRI lenders, a critical action toward to acquire property inside the Asia.

Why Asia try a nice-looking Marketplace for NRIs

India’s a property business keeps seen rapid increases, offering lucrative funding options. Products including a thriving savings, varied property items, and psychological really worth create Asia a top option for NRIs. In addition, of a lot NRIs see assets when you look at the Asia just like the a secure investment having its retirement ages otherwise because a bottom due to their families.

Eligibility Conditions for NRI Lenders

In advance of diving to your market, understanding the qualifications criteria to have lenders is vital. Basically, Indian financial institutions envision ages, employment condition, and you can earnings stability. NRIs generally speaking have to be useful a specific months from inside the the nation of their quarters and also a stable source of income.

Expected Papers

The fresh new papers process getting NRIs is much more stringent than for resident Indians installment loans online in Rhode Island. Secret files is passport and you may charge duplicates, overseas a job information, salary slips, and you can NRE/NRO bank account comments. Finance companies may also need an electrical power of attorney, enabling an agent within the India to cope with transactions.

Sort of Features NRIs Is Buy

NRIs are allowed to purchase almost all form of assets into the India but farming belongings, farmhouses, and plantation qualities. Wisdom which restrict is important to prevent judge difficulties.

Financing Keeps and you can Positives

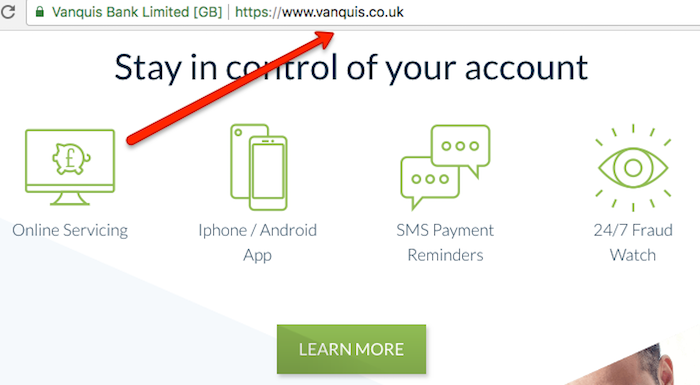

NRI home loans have have eg glamorous rates, versatile period, while the selection for a combined loan. The borrowed funds matter always utilizes the person’s income and you will possessions value. Particular banking institutions also provide special gurus like on line account administration.

Taxation Effects for NRIs

Investing Indian real estate includes their selection of income tax effects. NRIs probably know of the tax, resource increases taxation, and leasing income tax in the Asia. There are also advantages below various parts of the cash Income tax Work, and that’s leveraged.

Repatriation away from Finance

Knowing the repatriation legislation is vital. Brand new Set aside Financial regarding Asia lets NRIs to repatriate fund below certain conditions, that needs to be well understood to make certain conformity and easier resource.

Selecting the most appropriate Lender otherwise Financial institution

Selecting the right lender can be as crucial just like the deciding on the best assets. Facts such as for instance rates of interest, financing tenure, operating costs, and customer care gamble a life threatening character within decision.

The whole process of Obtaining and getting that loan

The mortgage application techniques concerns entry the application form with necessary data files, assets verification, loan sanction, finally, the mortgage disbursement. It’s an organized process that demands attention to detail.

Legal Factors and Due diligence

Courtroom research can’t be exaggerated. NRIs would be to ensure obvious assets titles, good strengthening permits, and you can an established creator. Seeking to legal counsel can be a wise action.To get assets into the India since a keen NRI is a huge financial and you can psychological decision. As the processes might seem overwhelming, knowing the subtleties from NRI lenders is also describe it. You may choose to complete comprehensive lookup and demand economic and judge advantages to make so it travels simple and rewarding. Towards the right strategy, running a dream household into the Asia is obviously within reach to own the worldwide Indian neighborhood.

Faq’s throughout the NRI Mortgage brokers

Here’s the directory of documents necessary for a keen NRI for a good mortgage:Passport and you may visa copiesProof out of household abroadEmployment and you may income data like paycheck slips, bank statements, and you may a position contractProperty-relevant data files like the title deed, NOC, and you may contract out of saleAdditional records may be needed depending on the lender.

Yes, NRIs can be pay back the mortgage inside their local money. The new installment can be done by way of Non-Citizen Exterior (NRE) otherwise Non-Resident Normal (NRO) account.

The borrowed funds period may differ by financial however, normally range out of 5 so you’re able to thirty years. Age the new applicant and you may retirement normally determine the tenure.

Interest levels for NRI home loans are very different from the financial and you will market criteria. They are usually quite greater than those getting citizen Indians. The latest costs could well be repaired or drifting, depending on the lender’s offering.

For many who standard to your an NRI financial, the results resemble people experienced by resident consumers. The lending company have a tendency to very first post reminders and you can sees for delinquent repayments. Proceeded standard can cause lawsuit, such as the initiation out-of recuperation steps underneath the SARFAESI Work. The property are going to be grabbed and you will auctioned to recoup the loan matter. While doing so, defaulting towards the a loan adversely impacts your credit score, impacting your ability to help you safer funds in the future, in both Asia and possibly in your country off house.

The maximum out-of an enthusiastic NRI home loan utilizes various points for instance the borrower’s income, payment capability, therefore the property’s worthy of. Fundamentally, banks inside the India loans to 80-85% of your property’s worth getting NRIs. The specific amount may differ between banks in fact it is determined based to the NRI’s money, the sort of assets are purchased, or any other qualifications criteria lay by the financial.

Yes, NRIs can also be claim a mortgage in Asia. He could be entitled to tax professionals towards the home loan repayments equivalent so you’re able to Indian people. These types of experts are deductions below Area 24 to have attention paid back toward the borrowed funds and you will not as much as Point 80C into the prominent installment. But not, to take advantage of such benefits, the fresh new NRI need file tax returns when you look at the Asia in the event that the earnings in the India exceeds the fundamental exception maximum. They should along with conform to the newest Foreign exchange Administration Act (FEMA) legislation.