Doctor Lenders

Also called a health care provider financing, this is simply not a guaranteed choice for no-off home loans, but it’s really worth exploring when you are a health care provider, nurse, otherwise medical care staff member. If you meet the requirements, you could find a zero-to-low down fee no PMI.

Zero-down financial options are restricted. However it does not always mean you should coughing right up 20% off for your house buy. In reality, discover countless low (think: anywhere between 3 and you may 5%) down-payment options.

FHA Loan

FHA money could offer lower down commission solutions plus much more everyday credit standards, making this sort of financing another choice path to homeownership.

Expert Idea

You’ll find 1000s of down-payment direction applications readily available, nonetheless they are different based on where you are. Lookup your state and condition to find out if your meet the requirements.

FHA fund are specially popular with first-date homeowners. End up being informed you are going to need to shell out PMI with this specific solution with the full mortgage term. Along with, FHA loans feature eligibility criteria including the absolute minimum borrowing from the bank score of 580, a debt-to-income ratio less than 43%, and you can proof regular earnings.

HomeReady and you will Family You can easily Mortgages

There are two main various other programs that exist to possess first-time homebuyers particularly: HomeReady and you will Family You’ll, states James McCann, older financing manager during the Modern Financing Team, a california-situated mortgage lender. Family Able can be found through Fannie mae, while Domestic You’ll exists through Freddie Mac computer.

HomeReady and you will Household You’ll be able to try payday loans Dacono conventional mortgages specifically designed having basic-time people and can make it step three% down. In lieu of authorities-backed money particularly Virtual assistant otherwise USDA mortgage loans, antique mortgages are from individual loan providers such as for instance banking companies otherwise credit unions. Certain conventional fund are backed by often Freddie Mac or Fannie mae, a few agencies paid from the regulators.

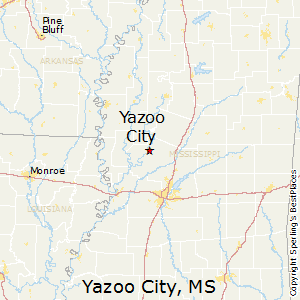

Will still be step 3% off, even so they give you a little bit of a break for the mortgage loan and you will, usually, for the private home loan insurance rates, McCann states. These two applications has a living restrict that’s address-specific. To determine when you’re entitled to an excellent HomeReady mortgage, utilize this map to discover the money maximum near you. Family You’ll be able to has the benefit of a comparable unit.

Antique 97 Financial

A conventional 97 financial is called as the they defense 97% of one’s residence’s purchase price which have a reduced deposit out-of just 3% off. They come using Freddie Mac otherwise Federal national mortgage association. Has just up-to-date, the latest brand-new type of traditional 97 mortgage loans is present so you can earliest-day homeowners otherwise whoever has perhaps not possessed within the last 3 years.

With this particular solution, you will need to explore PMI that can keeps a higher interest than the some of the most other federally-recognized choices, warns McCann. As you can get reduce PMI when you generate sufficient equity in your home.

Are PMI Beneficial?

If you place a little deposit (lower than 20%) to your a house purchase, you’ll usually end up being trapped paying PMI. If you find yourself PMI indeed advances the price of homeownership, it does nevertheless be worth it for many individuals. However, regardless if PMI may be worth it to you personally is based on your personal disease.

Home ownership, and you will to make mortgage repayments into the a house you possess as opposed to expenses book, will likely be a great way to make wide range throughout your house’s guarantee. And you can according to brand of financial, the other PMI costs won’t be permanent. So getting into a house in the course of time, could be much better finally.

However, owning a home is sold with extreme initial will set you back plus the lingering costs regarding keeping the house or property. After you reason behind brand new charging from keepin constantly your domestic and you may spending PMI, owning may possibly not be reduced month to month than renting, based on in your geographical area. Depending on how safe your source of income was, otherwise just how long you want to live in our home, race to invest in may possibly not be the best choice.