The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities. The company is scheduled to release its next quarterly earnings announcement on Wednesday, November 8th 2023.

- Style is an investment factor that has a meaningful impact on investment risk and returns.

- Last year, Upstart Holdings (UPST -0.69%) faced challenges in finding buyers for the loans its AI-powered platform approved.

- The company has worked to diversify away from personal loans and into larger automotive and home lending markets.

- This slowdown in demand has significantly impacted Upstart’s business, which has seen the transaction volume of loans (in dollars) in the second quarter fall 72% from last year.

- However, when interest rates rise, and demand for consumer loans is tepid, it puts a lot of pressure on its top and bottom lines.

It has forged partnerships with 61 auto dealerships to offer its loans and recently began dipping its toe into the home loan market by offering home equity lines of credit. These markets, plus personal lending, give the company a $4 trillion market opportunity. Some of these problems were alleviated in May when Castlelake, a global alternative investment manager, agreed to buy up to $4 billion in loans from Upstart. The news triggered a massive rally in the stock, which gained more than 400% in a few short months. Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements.

Recently Viewed Tickers

Tech and fintech stocks have not performed well this year in the face of rising interest rates. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. FICO’s beta can be found in Trading Information at the top of this page.

There are currently 2 hold ratings and 6 buy ratings for the stock. The consensus among Wall Street equities research analysts is that investors should “moderate buy” FICO shares. The analytics and credit score provider reports strong quarterly results boosted by higher mortgage originations. Style is an investment factor that has a meaningful impact on investment risk and returns.

FICO Stock News Headlines

Fair Isaac saw a increase in short interest in the month of August. As of August 15th, there was short interest totaling 567,400 shares, an increase of 6.4% from the July 31st total of 533,300 shares. Based on an average daily volume of 175,300 shares, the short-interest ratio is currently 3.2 days. 8 Wall Street equities research analysts have issued “buy,” “hold,” and “sell” ratings for Fair Isaac in the last year.

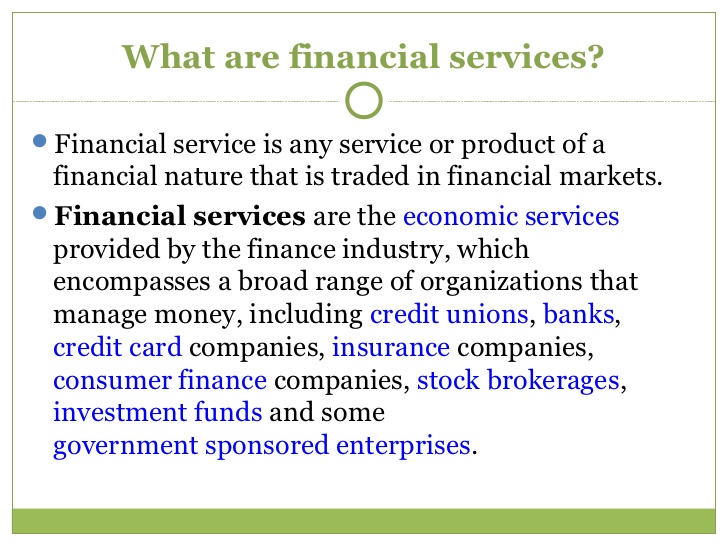

They rarely distribute dividends to shareholders, opting for reinvestment in their businesses. More value-oriented stocks tend to represent financial services, utilities, and energy stocks. Upstart uses its home-grown artificial intelligence (AI) models to price credit risk and help more consumers access loans than ever before, and often at better rates. Its goal is to improve on Fair Isaac’s traditional FICO scoring model, which it believes shuts some worthy borrowers out of the financial system, or rates them as riskier than they deserve. Founded in 1956, Fair Isaac Corporation, or FICO, established itself as the industry leader in credit scores, which turned out to be a very lucrative business. Credit scores are used for more than just individual lending decisions; they are benchmarks used by investors, lenders, and the industry overall.

Should You Be Adding Fair Isaac (NYSE:FICO) To Your Watchlist Today? – Simply Wall St

Should You Be Adding Fair Isaac (NYSE:FICO) To Your Watchlist Today?.

Posted: Sun, 20 Aug 2023 07:00:00 GMT [source]

The scores are based on the trading styles of Value, Growth, and Momentum. There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer.

© 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart’s disclaimer.

Dock Stops Over USD$50m a Month in Fraud for its Customers Using FICO Technology

Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. Upstart management keeps track of fully automated loans as a percentage of total loans originated. This number represents the number of loans originated where at no point an employee has to get involved — from the initial rate request to the signing of the loan agreement. Loan automation is one reason Upstart could quickly scale up from 300,000 total loans in 2020 to more than 1.3 million in 2021. One crucial component of Upstart’s business is the highly automated nature of its lending activity. Zacks Earnings ESP (Expected Surprise Prediction) looks to find companies that have recently seen positive earnings estimate revision activity.

Fair Isaac updated its FY 2023 earnings guidance on Wednesday, August, 2nd. The company provided EPS guidance of $19.70-$19.70 for the period, compared to the consensus EPS estimate of $19.70. The company issued revenue guidance of $1.50 billion-$1.50 billion, compared to the consensus revenue estimate of $1.49 billion. One of the most important personal financial planning tools for consumers is keeping a high credit score. A decent credit score has the potential to save borrowers thousands of dollars in interest exp… Upstart’s models continue to perform well compared to the traditional FICO scoring system.

Fair Isaac (FICO) Q3 Earnings Beat, Revenues Improve Y/Y

Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index (Market Barometer) quotes are real-time. This site is protected by reCAPTCHA and the Google

Privacy Policy and

Terms of Service apply. We’d like to share more about how we work and what drives our day-to-day business. Compare

FICO’s historical performance

against its industry peers and the overall market.

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.32% per year. These returns cover a period from January 1, 1988 through July 31, 2023.

The industry with the worst average Zacks Rank (265 out of 265) would place in the bottom 1%. An industry with a larger percentage of Zacks Rank #1′s and #2′s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4′s and #5′s. The Zacks Industry Rank assigns a rating to each of the 265 X (Expanded) Industries based on their average Zacks Rank.

Fair Isaac Co. (NYSE:FICO) Shares Acquired by First Republic … – MarketBeat

Fair Isaac Co. (NYSE:FICO) Shares Acquired by First Republic ….

Posted: Wed, 06 Sep 2023 10:28:21 GMT [source]

Fair Isaac’s stock is owned by a variety of retail and institutional investors. After Wednesday saw the S&P suddenly jump, CNBC’s Jim Cramer looked back at ten stocks that performed well even when the index bottomed out last October. The credit scoring giant has been especially hard hit in the downturn.

The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season. As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style. The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. Highlights important summary options statistics to provide a forward looking indication of investors’ sentiment.

However, it faces challenges in the near term due to the economic conditions that have significantly slowed down demand for consumer loans. According to Federal Reserve data, U.S. banks have reported tighter lending standards and weaker loan demand from businesses and consumers in the second quarter. This slowdown comes as banks cite a more uncertain economic outlook and expected credit quality deterioration. The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals. Unique to Barchart.com, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods. Results are interpreted as buy, sell or hold signals, each with numeric ratings and summarized with an overall percentage buy or sell rating.

Provides a general description of the business conducted by this company. The Barchart Technical Opinion rating is a 100% Buy with a Strongest short term outlook on maintaining the current direction. Upgrade to MarketBeat All Access to add more stocks to your watchlist. types of defects in quality control 371 employees have rated Fair Isaac Chief Executive Officer William Lansing on Glassdoor.com. William Lansing has an approval rating of 89% among the company’s employees. Fintech and tech stocks have started to bounce back in 2023 after a painful 2022.

Style is calculated by combining value and growth scores, which are first individually calculated. When interest rates are low and loan demand is robust, it can make more loans, earn more fees, and deliver stellar earnings as it did in 2021 and 2022. However, when interest rates rise, and demand for consumer loans is tepid, it puts a lot of pressure on its top and bottom lines. This slowdown in demand has significantly impacted Upstart’s business, which has seen the transaction volume of loans (in dollars) in the second quarter fall 72% from last year. Fellow consumer lender LendingClub experienced a similar hardship as originations dropped 48% in the second quarter.

After each calculation the program assigns a Buy, Sell, or Hold value with the study, depending on where the price lies in reference to the common interpretation of the study. For example, a price above its moving average is generally considered an upward trend or a buy. Investors should take a patient approach to the stock right now, keeping an eye on its model performance over the next few quarters in the context of the broader economy. The company has worked to diversify away from personal loans and into larger automotive and home lending markets.

Dividend yield allows investors, particularly those interested in dividend-paying stocks,

to compare the relationship between a stock’s price and how it rewards stockholders through dividends. The formula for calculating dividend yield is to divide the annual dividend paid per share by the stock price. Management has achieved this while maintaining low fraud rates by increasing the accuracy of its AI models, eliminating previously manual processes, and growing the number of repeat borrowers on its platform. While there is a limit to how many loans can be automated, this high rate should help Upstart maintain healthy margins. The technique has proven to be very useful for finding positive surprises. In fact, when combining a Zacks Rank #3 or better and a positive Earnings ESP, stocks produced a positive surprise 70% of the time, while they also saw 28.3% annual returns on average, according to our 10 year backtest.

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

- Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations.

- The monthly returns are then compounded to arrive at the annual return.

- The credit scoring giant has been especially hard hit in the downturn.

- In fact, when combining a Zacks Rank #3 or better and a positive Earnings ESP, stocks produced a positive surprise 70% of the time, while they also saw 28.3% annual returns on average, according to our 10 year backtest.

A stock’s beta measures how closely tied its price movements have been to the performance of the overall market. Morningstar analysts hand-select direct competitors or comparable companies to

provide context on the strength and durability of FICO’s

competitive advantage. Volatility https://1investing.in/ profiles based on trailing-three-year calculations of the standard deviation of service investment returns. The industry with the best average Zacks Rank would be considered the top industry (1 out of 265), which would place it in the top 1% of Zacks Ranked Industries.

Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. High-growth stocks tend to represent the technology, healthcare, and communications sectors.