If you find yourself good co-op proprietor, you could potentially ponder if you’re able to rating property security mortgage. Whatsoever, this type of fund enable you to utilize your residence security to pay getting renovations, consolidate loans, or fund tall expenditures. While it’s fairly simple to find a home equity mortgage towards the just one-family home or condominium (and if your meet with the qualifications), getting financing should be difficult getting co-op owners because of co-op panel and lender limits.

Trick Takeaways

- A co-op is a type of domestic housing owned by an organization where residents are voting shareholders of this firm.

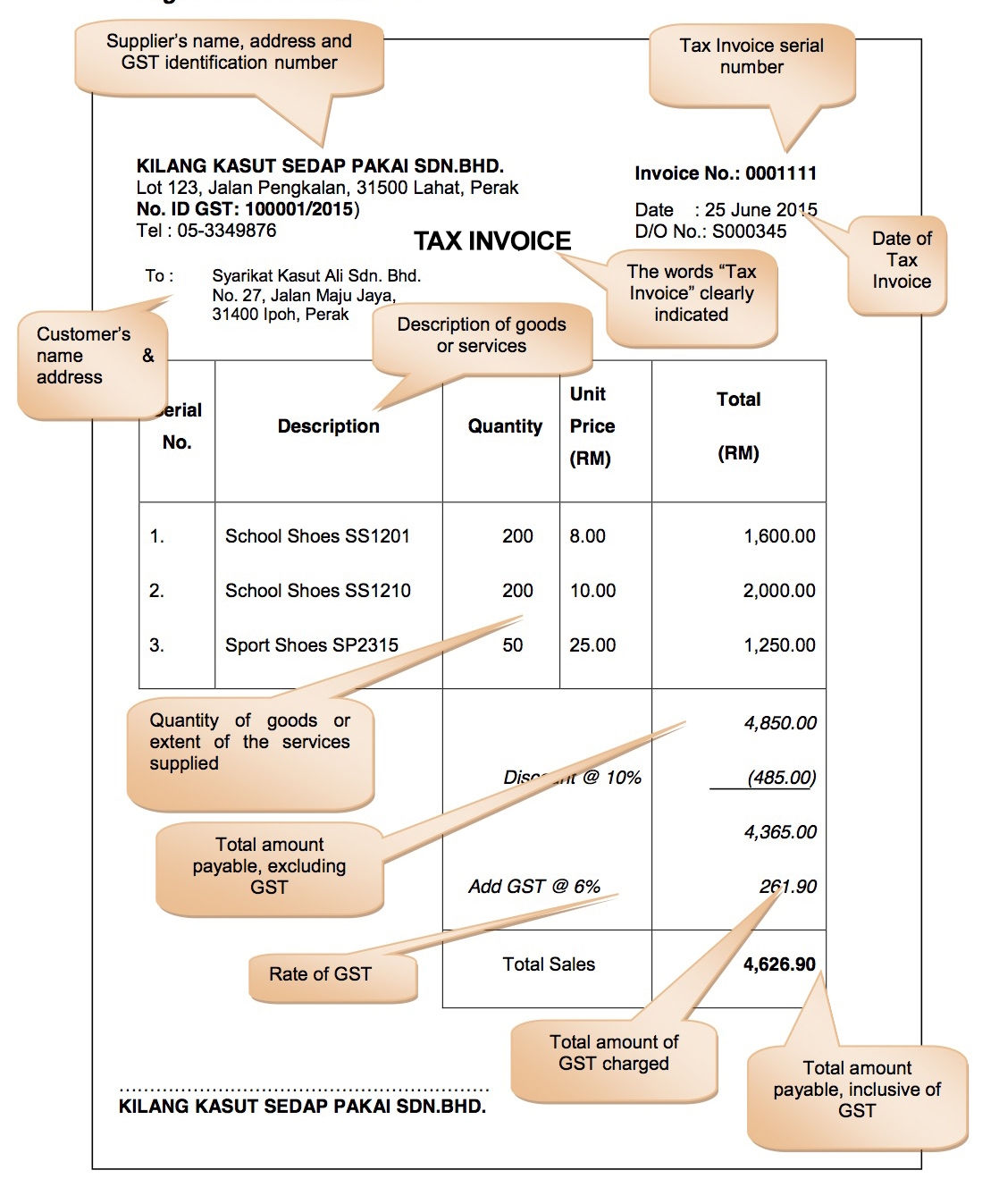

- A house security financing lets you make use of their security in the place of attempting to sell otherwise refinancing your property.

- Their bank pays you a lump sum, you pay back that have repaired notice more a selected financing name.

- Certain co-ops allow people locate domestic guarantee money, but the number you could acquire are limited.

- Of many lenders avoided giving domestic equity financing of any kind during new pandemic.

What’s a good Co-op Flat?

An excellent co-surgical apartment, otherwise co-op, is a kind of residential housing owned by a business. Co-op citizens is voting shareholders of your agency and area-people who own the entire strengthening, which have a straight to inhabit among apartments. Co-ops basic starred in Nyc for the 1876. Today, over 1 / 2 of all of the co-ops can be found here, though you may also find them various other higher towns and cities.

What exactly is a house Equity Financing?

A home equity financing lets you make use of your own collateral-this new part of the residence’s worth that you currently own-to fund almost everything you could potentially wish. Brilliant spends could be home improvements, debt consolidation reduction, and you may huge-pass instructions particularly a home, a special business, or scientific expenses. Your financial gives you a lump sum during the a predetermined attention speed and you pay back the amount in the monthly obligations, the amount of and therefore continues to be the same over the financing label, always between five and you can 3 decades.

The borrowed funds number relies on multiple circumstances, together with your credit rating, income, and you will home equity, as well as the house’s fair market price. The loan was a secured debt-with the house helping since equity-as well as your lender can also be foreclose for individuals who avoid and also make repayments.

Is it possible you Rating a house Collateral Loan to the good Co-op?

You’re capable of getting a property equity loan toward the co-op nonetheless it ily house, townhouse, or condo. The reason being, instead of those old-fashioned houses choices, a beneficial co-op actually real estate, hence complicates issues.

If you need a home guarantee mortgage to the a good co-op, you’ll face a few demands outside of the regular financing certification hoops. First, just like the co-op board kits the guidelines towards the monetary operation of your building, you may need https://elitecashadvance.com/installment-loans-co/hudson/ its recognition. You can restrictions about how far you might acquire might be created into the issues including the property value the apartment along with your debt-to-money (DTI) proportion.

The second hurdle is actually seeking a loan provider that provides co-op home collateral loans. Many financial institutions-together with Chase, Wells Fargo, and you can Citi-stopped brand new home collateral money and you can family security credit lines (HELOCs) in pandemic. This makes it one thing off problems to acquire a financial one to already also offers one family security money, let-alone for co-ops.

Financial institutions that do offer household equity loans tend to have rigorous requirements. Eg, Bank out-of The united states told Investopedia so it also provides a hybrid HELOC which can function as a home equity financing and therefore product can be found to possess good co-op. Yet not, co-op residents must have 100% equity so you can be considered, just like the loan should be the elderly personal debt towards possessions.