The process of providing preapproved for buying a home shall be a little nerve wracking, particularly if you will be a first-time homebuyer.

The first thing are finding a home loan company or broker. Delight comprehend my post, As to the reasons Get Pre-Recognized having home financing and just how Manage I’m sure Who ‘s the Right Lender For me?

To shop for a home is sometimes a little nerve wracking. My party and i also try here to hang their hands and you will help you every single step of means! We all have been using the the technical offered but along with like functioning the existing-designed ways of the conference deal with-to-face. We are going to help when you look at the almost any trends best fits your circumstances and you may wants.

Once you’ve chosen a loan provider, you may be happy to submit a pre-approval software. My preferred lenders feel the app techniques on line, otherwise, you could meet her or him them personally if you like otherwise actually perform the app over the telephone. Either way, you are going to provide information about the kind of mortgage your seek, your income, an such like.

Precisely what the Application Needs undergoing Bringing Preapproved

That it software need you to definitely divulge your own label, addresses for a couple of years, birth day, public safety number and you may works records the past couple of years, and factual statements about your money. Pre-approvals need a credit history for everyone consumers.

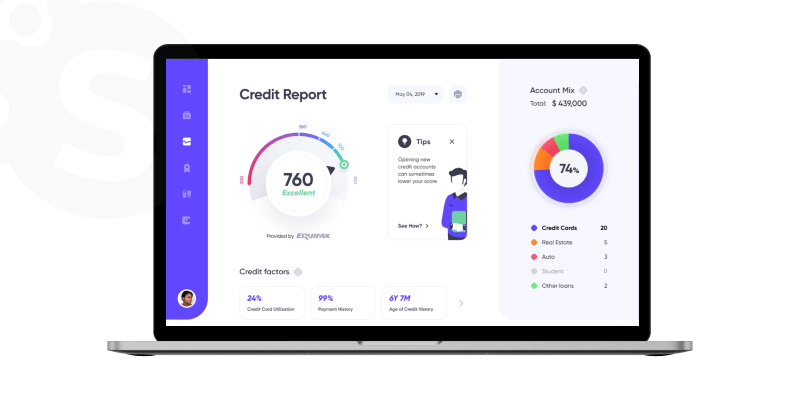

The borrowed funds administrator spends every piece of information given toward financial software to acquire a credit history with three credit agencies. So it declaration are examined of the lender’s underwriter to ensure the borrowing assistance was met.

Your credit score includes the financing score certainly other extremely important parts of information. Credit score conditions count on the loan program removed. The lender together with talks about their payment history and you may monitors so you can see if you can find one major borrowing facts. Recent bankruptcy, property foreclosure otherwise delinquent income tax liens is actually reasons why you should refuse financing.

Most of the time, my personal preferred bank can be work with your pointers compliment of an automated underwriting procedure and acquire a first pre-acceptance, but then we nonetheless wade subsequent.

The lending company will make you a whole variety of the files (I call it the laundry checklist) they want once you sign up. Particular records are expected from the anyone, like this list less than but even more data files may be needed dependent on a state. Might, very first documents you’ll want to give are:

Pay Stubs To possess Earnings Confirmation While you are working, the lending company will demand present shell out stubs and regularly W-2′s for the most current several years. Lenders calculate your own ft income and see or no overtime, incentive otherwise income can be used to be eligible for the mortgage. Lenders can also require a-two-12 months reputation of finding income, overtime or incentives before that earnings are often used to pre-be eligible for the loan.

Tax statements Plan on offering the history 2 yrs of taxation statements. A number of low-a position money, for example interest and you may dividends, advancing years earnings and you may personal cover income, need tax returns also. For people who individual a pals you to definitely files corporate taxation statements, you may need to offer any business output, in addition to people K-1′s, money files like good W-dos or 1099 which might be approved for you if for example the organization try a partnership otherwise S-Corporation).

A career Confirmation This will be a listing of their companies getting the latest pat 2 yrs including names, details and you can telephone numbers.

Financial Comments You may be necessary to bring documentation regarding where the latest down payment and you may closing costs are coming from. The most common provider files is lender comments otherwise investment statements. Of several loan providers do not allow cash on hands (currency kept away from a banking establishment) for usage to own a down payment otherwise closing costs. If a family member, providers or non-profit is actually providing something special or offer towards off fee, you will be required to give a present letter and you will facts your donor provides the finance to provide. Usually two months’ financial statements are needed.

Extra Records Based on exacltly what the records shows, you may have to provide facts. Educators are usually questioned to provide its a https://paydayloansconnecticut.com/coventry-lake/ position package, since they can be repaid more nine, ten otherwise 1 year, and then make calculating the cash regarding a wages stub by yourself difficult. In addition, lenders may request you to determine higher low-payroll deposits, minor bad factors in your credit file or a name difference. This is exactly common for ladies exactly who transform their brands after they e with a father.

Self employment Records. In the event the applicable. Individuals who are self employed may have to bring a lot more or alternative files including money-and-losings statements, Government taxation statements and/otherwise balance sheet sets for the past couple of years.

Disclosures The borrowed funds administrator and mortgage lender who underwrite the loan, when they independent organizations, is one another necessary to offer documentation once you apply having a pre-recognition. Both loan officer and you will lender will give you a good Good-Faith-Imagine, otherwise GFE.

It document shows you the expenses and you will regards to the mortgage you provides applied and you may started recognized to have. you will be offered a duplicate of one’s application and you may of a lot disclosures, and additionally notification of one’s to a copy of one’s assessment, servicing revelation declaration (reveals just how many finance the firm keeps otherwise carries) together with Affiliated Company Arrangement (explains what 3rd-group businesses are as long as you qualities). The loan officer keeps around three business days from your own application to help you present a great GFE, and the lender provides around three working days from the time it get the applying to give you a great GFE too. Very alter towards amount borrowed, rates otherwise terms and conditions will need a different sort of GFE be offered.

Completion and Summation undergoing providing preapproved I’ve thrown a lot of suggestions in the you using this blog post. Very why don’t we summary a few of the key points. Home loan pre-acceptance are a system the spot where the financial product reviews debt history (credit rating, earnings, debts, etcetera.). They do this to ascertain in the event you’re qualified for a financial loan. They’ll also show just how much he is prepared to provide you.

Very, there is certainly a touch of strive to manage initial while making sure you can purchase a house, but when its done, we could work at in search of your your ideal house. Please give me a call anytime for a no obligation visit.